‘Portable Forms of Wealth’ The Four Elements to Successful Diamond Investing

As markets fluctuate more and more, investors head to alternative uses for their money, and diamond and gemstone investing could be the next best way to get rich, it’s been suggested, if an investor knows what to look for in the precious stones.

Via Express.Co.UK / By Samantha Leathers

Alternative investments, like real estate and gold, have been fan favourites in the investment world for a while, and with stocks and bonds prices rising, real assets like these are becoming the most feasible option for beginner, low-risk and low-budget investors alike. Tobias Kormind, co-founder of 77 Diamonds, shared his expertise with Express.co.uk the 4C’s of diamond investing and said that investors can start with the same cash amount as an ISA, making getting rich more accessible than ever before.

“Traditionally, gold is the all-time fail-safe investment” commented Mr Kormind, “but gold may now have a more glittering contender, and one that’s not only reserved for the rich and famous, but can be worn or carried in your pocket.

“Over the past year, investors have turned to diamonds and gemstones to weather looming inflation rates and reduce their exposure to the impact. This is because diamonds and precious gems, much like gold, are portable forms of wealth and can more easily resist price inflation.

It’s important to note that with any investment, capital is at risk and investors are advised to never put in more than they can afford to lose.

Mr Kormind added: “To avoid any bad surprises long-term, it’s important for budding investors to do their research, and find that one gem that’s a cut above the rest.” Tobias Kormind is the co-founder & Managing Director of 77 Diamonds, Europe’s largest online diamond jeweller, based in Mayfair & Manchester. He’s given a few pointers on where to start research:

The 4Cs

Mr Kormind explained that understanding the 4Cs are the first obstacle in the glamorous world of diamonds: “That’s carat, colour, cut and clarity and – yes – each will determine the end value of your stone. Look at it as a sort of checklist before you commit to any purchase and try to understand what’s most important to you in a diamond.”

Purchasing diamonds that are known to be sought after in the market will help an investor to sell them when they’re looking for returns, and the criteria for these sought-after gems lie in the 4Cs.

Carat

Often bigger means better and it’s easy to assume that is true when it comes to diamonds, but it’s the Carat that counts at the end of the day.

“Carat measures a diamond’s weight, where 1.0ct equals 0.20 grams. In the natural white diamond market, the price for half a carat (0.50ct) to one full carat (1.0ct) rises approximately four-fold, and this continues exponentially due to the relative rarity of larger diamonds.

Mr Kormind advised: “A budding investor should invest in diamond sizes that are more in demand (for example: 0.50ct, 1.0ct, 1.5ct and 2cts), as they are much easier to sell again.”

Colour

Colour can greatly increase or decrease the value of a diamond, and having a good understanding of what true diamonds look like can also help investors avoid scammers.

In the world of diamonds, colour grading is used to measure how much yellow tint is within a white diamond, with the most sought-after stones have very little colour.

“The colour scale runs from D to Z, with D being the highest grading. Invest in a diamond that has little noticeable colour (H and above) as this is more desirable for future buyers.”

This isn’t to say that coloured diamonds are worthless, the variety of brilliant colours can also fetch a healthy sum.

Mr Kormind noted: “Pink diamonds, for example, are so scarce and highly investable that they have seen their value increase by around 300 percent over the past decade. A small pink diamond costs as much as a large white one and as more people become aware of these gems, demand will continue to push up prices due to their very limited supply.”

Cut

It’s important to understand that the cut of the diamond is not necessarily the shape, but how it reflects light due to its polishing.

“A superior cut diamond with even facets, refracts and reflects light optimally, creating a mesmerising and glittering finish. This grading can range from Poor to Excellent, and would-be investors should always try to aim high to maximise the desirability and hence profit,” he explained.

Clarity

Every diamond and gem is unique, this means their imperfections will be as well. Mr Kormind explained that the mineral impurities in diamonds where present when the diamond was first formed billions of years ago and is generally visible to the naked eye.

“It’s best to purchase an ‘eye clean’ diamond, meaning a grade VS2 and higher, as visible imperfections will only serve to devalue the desirability of your stone.”

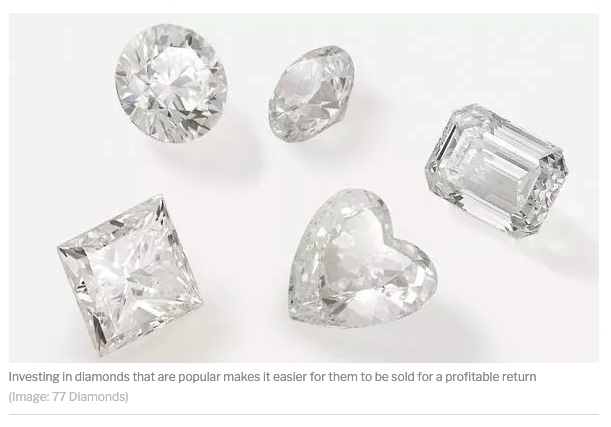

Mr Kormind continued: “Other points to keep in mind are a diamond’s shape and grading report. Usually, investors tend to purchase round-shaped diamonds, as they are more popular. Other shapes, known as fancy cuts, are less in demand. As an example, a heart or marquise-shaped diamond is less desirable and so harder to sell, which may reduce the final returns.

“Always make sure you buy your diamond from reputable sources and have it checked by independent, qualified experts. Try to only purchase stones graded by the Gemological Institute of America (GIA), a non-profit organisation that sets the industry-standard of grading for diamonds.”