Investment Markets Continue to ‘Rock N Roll’

Investors could be forgiven for thinking that they were on the financial equivalent of the Rock N Roll ride at the local show with market gyrations continuing over the last week. Another extension to Brexit had a dampening effect on markets as Boris insists on going to an election (again), while the US share market hit a record high based on the news that Trumpkin said a “Phase One” trade deal could be signed with China next month. Of course, this begs the question, “How many Phases will there be?” especially for a world that is getting tired of the trade trench warfare.

Trump’s election initially led to rising sentiment in corporate America mainly due to reducing the corporate tax rate from 35% to 21%. After three years however, the mood has changed because the “sugar hit” of tax cuts has worn off. Most companies used the extra cash to buy back their shares, which has the effect of pumping the market price and boosting executives’ take home pay. That level of investment has dropped significantly, so those same executives are worried about where the next boost to the bottom line will come from.

This is especially the case when none of the cash was invested in new equipment, software, product development or buildings – you know the type of spending that ensures a business can thrive in the future. Australian politicians too have tried their own sugar hit with tax offsets but that hasn’t led to the hoped-for boost in retail sales. Stock markets here are also a bit nervous with a couple of IPOs – Latitude and Retail Zoo – being withdrawn, even with the former downgrading its valuation prior to launch.

Different news for property investment. Real estate investors are back in the market in record numbers with auction clearance rates in some cities getting to around 75%. This will only add to Australia’s record level of household debt – It’ll be known as the boom we didn’t have to have. All of the on-going uncertainty means that investors have to think outside the square when it comes to boosting returns for their portfolios while lowering volatility.

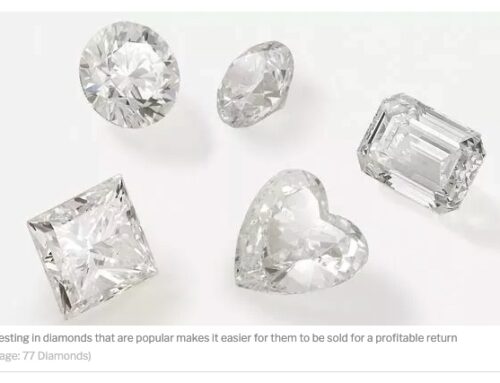

One of the best ways to do this is to invest in Argyle pink diamonds, the rarest of pinks with a finite supply. And we all know what a finite supply will do to prices over the medium to long term – it will lead to sustained capital growth. But to get that capital growth, you need to purchase your Argyle Diamond at a wholesale price – not the retail price. Argyle Diamond Investments have the largest selection of investment grade Argyle pinks at the best wholesale prices. Call us today so we can provide you with your ideal (and rare) investment gemstone.