Why You Should Invest in the Last of the Argyle Pink Diamonds

Via Mark Westall @ FAD Magazine

Hailing from the Argyle mine in Western Australia, these rare, intriguing, and praiseworthy gems shine and sparkle in hues of pink. That’s what makes them rare. The Argyle Pink Diamonds have always been prized, and are worth far more than regular white diamonds. Ever since its discovery, the Argyle pink diamond has been considered as the most esteemed diamond in the whole world. Its rarity does not even allow it to reach the open market. Unfortunately, now that the supply is dwindling and the largest mine is closing by 2020, this changes how the Argyle pink diamonds are going to fare in the market.

The Argyle Mine

The Argyle Diamond Mine, from which the diamond gets its name, has been operating and mining diamonds in the East Kimberley region of Western Australia since 1983. It has operated as the third biggest supplier of the world’s diamonds. While there are other diamond mines, the Argyle Mine has always been the largest supplier of pink and brown diamonds. From yielding 8 million carats a year, the once diamond powerhouse is expected to exhaust the last of their supplies before 2020 ends. After then, they would cease to operate and start the rehabilitation of the area.

What Is Going to Happen to the Last of the Argyle Pink Diamonds?

When the final production of the Argyle mine sells out by 2023, about 90% or 14 million carats of the world’s supply of pink diamonds would drop. The closure would also lead to a 10% drop in the world’s annual diamond supply. This means the value of the Argyle Pink Diamond would push through the roof.

What is being done about the closure?

The looming of the end of the Australian diamond industry sends a flurry of exploration. With the largest diamond mine closing in a year, prospectors have started to seek new sources. Having recovered with about 7 macro diamonds and 112 micro-diamonds, Little Spring Creek of Australia has been considered to be among the best prospects in decades. The quality of the diamonds is yet to be tested, but the amount of diamonds recovered is truly promising.

Owner of the Argyle Diamond Mine, Rio Tinto, has started the rehabilitation and the cleaning up of the mine, however it will no longer be used for pink diamond mining. Perhaps, it would be used for something else other than mining while the Argyle workforce may have to move to Rio Tinto’s iron ore business.

What can you do?

Taking into consideration the law of supply and demand, the smart thing to do, now that the value of the Argyle Pink Diamond is foreseen to skyrocket, is to invest while you still can. Check out Leibish’s natural loose Argyle diamonds collection if you are looking to buy authentic pink diamonds. When the largest producer of the most valuable diamond closes, the pink diamond is going to be even rarer, and the demand, higher. The prices have grown exponentially over the last few years, more so when the news of the Argyle mine closure spread. Right now, the Argyle pink diamond’s value could rise up to several million dollars per carat. It even escalates by 13.8% per annum. Its value is definitely not going anywhere but up. In fact, in just 20 years, its value has already appreciated 500 percent.

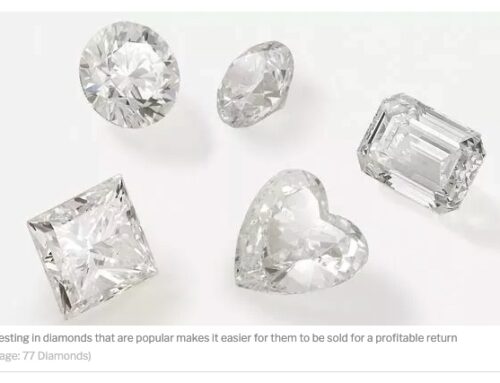

To take advantage of the rise of the value of the Argyle Pink Diamond, investing in at least one piece is the best choice. You can get high quality Argyle diamond jewelry, or loose Argyle diamonds. When investing in pink diamonds, it is important to remember that rarity affects the price of any gem. This means if you wait until the mine finally closes and pink diamonds have grown exceedingly rare, you will have to expect the price to increase by several million dollars per carat. You would wish you took your chance when you had the opportunity to invest in the Argyle pink diamond at a lesser value.

Even if a new mine of pink diamonds is discovered, recovering of the diamonds would still take at least a decade before the market could finally see it.

The best way to take advantage of the looming end of the Argyle mine is this: invest in loose pink diamonds. The heightened demand and rarity of the exquisite pink diamond may make it the perfect investment right now.