Colour Diamonds: The Fairest of Them All

The fancy colour diamond category is as dynamic and varied as the stones themselves. ARABELLA RODEN explores new trends and opportunities for retail jewellers.

March 15th 2020 via jewellermagazine.com

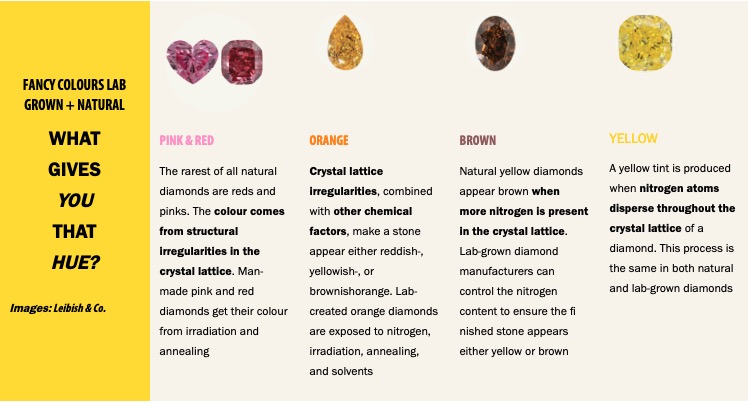

There is little argument when it comes to the demand for fancy colour diamonds. A recent analysis, undertaken by the Fancy Color Research Foundation (FCRF) found prices for pink diamonds had more than doubled over the past 10 years; the figure was 81 per cent for blue diamonds, and 21 per cent for yellows.

As economic principles tell us, this phenomenon is driven by the law of supply and demand; when demand outstrips supply, prices rise.

In the case of natural fancy colour diamonds, demand has risen precipitously over the past 15 years – illustrated by record-breaking auction prices, such as the $US50 million ($AU75.5 million) paid for the Pink Legacy diamond in 2018 or feverish bidding at the annual Argyle Tender.

Natella Aminov, director Vital Diamonds, tells Jeweller that colour diamonds have become one of the strongest categories for the business alongside colourless (white) diamonds. Vital Diamonds is now one of the largest suppliers of yellow and brown diamonds in Australia.

Demand has also come in the form of ‘diamond investors’ – those who purchase fancy colour diamonds as an asset class.

“Usually, people would like to buy a pink diamond for investment,” says Maulin Shah, director, World Shiner.

“We get inquiries for pink diamonds according to the different customers’ budget – what they want to ‘invest’ – rather than a particular size.”

International diamond supplier Kunming Diamonds began specialising in fancy colours of all sizes, shapes, and hues in 2002 and began stocking Argyle stones in 2011.

After recently touring Australian cities with Kunming’s extensive selection of stones, director Harsh Maheshwari says local jewellers are embracing the category, often choosing yellow and brown diamonds as an affordable “entry point”.

“It’s a big misconception, when it comes to colour diamonds, that they are all extremely expensive,” he explains. “Of course, the main component is colour, so if jewellers focus on that more than size and clarity, they will be able to find something within their range. It may be smaller, but it will be beautiful.”

He advises jewellers to be open to a range of different diamonds, as very specific requests can be difficult – and expensive – to fulfil.

Steve Der Bedrossian, CEO SAMS Group Australia, says jewellers should choose a supplier who can offer a range of options to suit their budget.

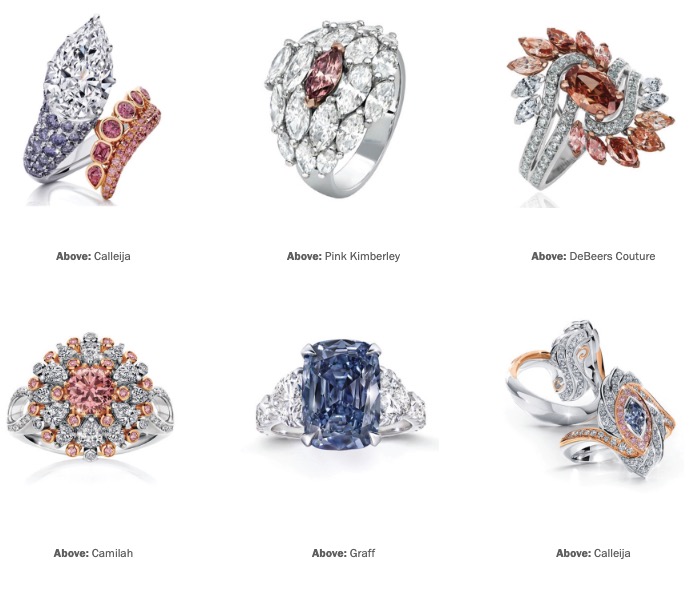

“SAMS Group can design plans and packages to suit our clients’ requirements, both in terms of budget and window display. We also offer branded pink diamonds – Pink Kimberley and Blush Pink,” he explains.

Consumer appeal

Different demographics of consumers are captivated by fancy colour diamonds, but the stones are particularly appealing to educated and passionate jewellery lovers, says Maheshwari.

“A mature consumer – someone who already owns a colourless diamond or gemstone – may be looking to buy something different, with more intrinsic value. Colour diamonds have a story that differs to a colourless diamond.

“For someone who’s ready to spend money, when you give them the story behind the coloured diamonds – why they are different, why they are so rare – it really attracts them.”

Meanwhile, Katherine Kovacs, director K&K Export Import, argues that fancy colour diamonds also appeal to younger consumers.

“Millennials are more likely than previous generations to seek out gemstones with a point of difference, that are unique and non-traditional.

“Colour diamonds are a way of providing a non-traditional option with fantastic durability and brilliance,” she explains.

The desire for a ‘point of difference’ has translated into the trend for salt-and-pepper diamonds among Millennials. The stones get their distinctive celestial appearance from a variety of inclusions, and have developed a niche as statement jewellery and alternative engagement rings.

“Salt-and-pepper diamonds provide the perfect solution for jewellers wanting to create high-end jewellery with a hint of that ‘natural’ aesthetic,” explains Brendan McCreesh, managing director O’Neils Affiliated, which stocks salt-and-peppers alongside colour gemstones.

“They break away from the tradition of ‘clean and flawless’ gems yet maintain a highly fashionable style which can be applied to many different manufacturing techniques. The material we source is perfect for Australian designers who work to a price point or a particular look,” he adds.

Indeed, it is that one-of-a-kind quality that makes fancy colour diamonds of all kinds so compelling to consumers – and advantageous for retail jewellers. The unique hues allow for creative pieces that are both eye-catching in the window and impossible to buy from competitors.

“Fancy colour diamonds – like colour gems – tell a story,” says Brett Bolton, director Bolton Gems. “The stone is not just a ‘G Si1 Ex Ex Ex, no BGM [brown, green, milky], no fluorescence,’ where the only difference between one and the next 50 is the position of the inclusion. Each stone is unique in colour, secondary colour, cutting, fire.”

Shah adds, “Each and every fancy colour diamond is unique, so it’s a great opportunity for jewellers to make some extra margin on their product.”

Yet while demand is evidently growing, supplies have become more limited.

The end of an era

The supply-demand dynamic will become more extreme in the future, as the world’s premier source of pink diamonds, Rio Tinto’s Argyle Mine in Western Australia, is scheduled to close at the end of 2020.

Argyle opened in the mid-1980s and currently accounts for 90–95 per cent of the global pink diamond supply. It also produces blues, yellows and browns, often sold as ‘cognac’, ‘champagne’, and ‘chocolate’ diamonds.

“Since summer last year, more and more jewellers are reaching out requesting Argyle pinks, trying to get the last piece of the pie,” says Maheshwari.

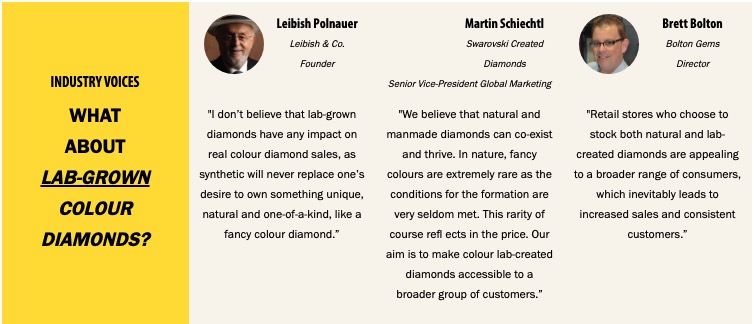

Leibish Polnauer, director of international fancy colour diamond supplier Leibish & Co., notes: “Rio Tinto closing the Argyle mine will lead to a massive decrease in pink diamonds, meaning that prices will continue to inflate. I don’t advise jewellers to stock up on all colour diamonds, however if they are looking to invest in one, I would recommend stocking up on Argyle [pink] diamonds as these are the most sought after [by consumers].”

Bolton agrees. “As we approach the conclusion of the Argyle Mine – and the reality of this sinks in for consumers – Argyle pinks and Argyle products in general become increasingly rare, valuable, and desirable,” he says.

Der Bedrossian – whose brands exclusively feature Argyle diamonds – says origin is now “as important as the other 4 Cs” for the local market.

“The certificate of Argyle origin is essential – especially for Australian consumers. Many feel patriotic buying an Australian product,” he explains.

Indeed, Argyle has been the lynch pin of the Australian diamond industry for decades and is currently the country’s only active diamond mine.

The Merlin Diamond Mine in the Northern Territory, which had previously produced brown and blue stones, is currently dormant after the Federal Court appointed liquidators to its parent company, Merlin Diamonds Ltd, in 2019.

Meanwhile, the Ellendale Mine in Western Australia, which once produced half the world’s yellow diamonds, was closed in 2015 when its previous operator, Kimberley Diamond Company, went into liquidation.

It may return to productivity in the coming years; Australian mining company Gibb River Diamonds recently took over the lease after a rejuvenation project by the West Australian government.

However, it is not known when the site will become fully operational. In order to satisfy consumer demand for fancy colour diamonds, jewellers will need to look further afield.

New Diamond Sources

Russian mining conglomerate Alrosa – the world’s largest diamond producer by volume – has indicated it intends to become the world’s premier source of fancy colour stones.

Pavel Vinikhin, director cutting and polishing division, Alrosa, recently told the Russian news service TASS: “[Following] the closure of the Argyle Mine in Australia, we will become the world’s largest producer of coloured diamonds and can therefore go after leadership in the coloured diamond market.”

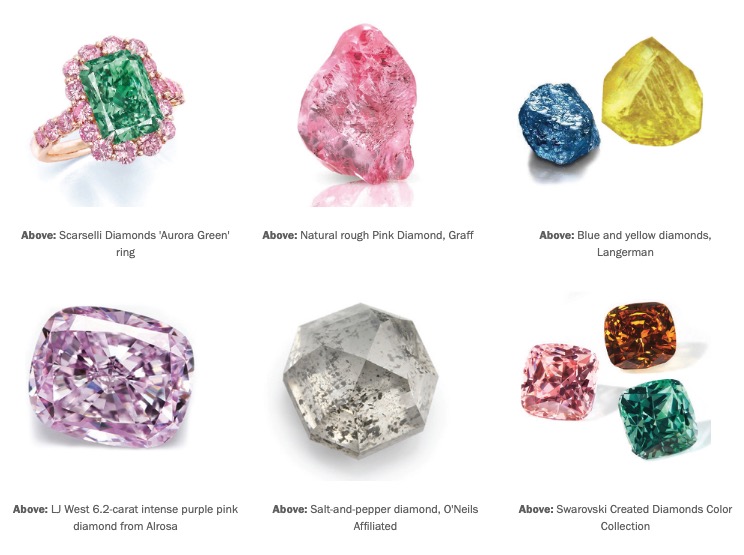

Indeed, Alrosa has unearthed several notable colour stones in recent years, including the 14.83-carat fancy vivid purple pink it named ‘Spirit Of The Rose’. It holds the high-profile True Colors Auction each September, with the diamonds available to view at the Hong Kong Jewellery Fair.

Colour diamonds currently account for less than 0.1 per cent of Alrosa’s total output and most originate from the remote Yakutia region in Siberia.

In February, New York-based fancy colour diamond supplier LJ West Diamonds purchased a 6.21-carat intense purple-pink Yakutia stone.

In what could be interpreted as a ‘sign of the times’, it was the first time the business had sourced a diamond from Alrosa in its 40-year history.

Scott West, executive vice-president LJ West Diamonds, told JCK Online, “Siberia has a lower quantity [than Argyle] but is still a somewhat consistent production… [And] because Siberia is so big, there is the potential to find new mines.”

Following the LJ West sale, Alrosa announced a 17.44-carat yellow diamond had been found in Yakutia.

Botswana may also prove to be a source of colour diamonds in the future; mining company Lucara unearthed a 9.74-carat blue and a 4.13-carat pink at its Karowe Mine last year. Karowe previously yielded two other notable blue stones.

Eira Thomas, CEO Lucara, said at the time, “Lucara is extremely pleased with the recovery of these rare, sizeable, fancy coloured diamonds, which have the potential to contribute meaningful value to our regular production of large, high-value type IIa diamonds.”

However, no mine has produced colour diamonds as consistently as Argyle.

With pink diamonds alone priced at between $30,000 to more than $1 million per carat, jewellers and consumers have searched for an alternative.

Enter lab-created colour diamonds. Swarovski – best known for its cut crystal and gemstone jewellery – recently entered the category in the US and Europe with the Swarovski Created Diamonds Color Collection.

The Color Collection – which includes 16 hues – is available as loose stones for Swarovski B2B customers, and to consumers as Atelier Swarovski jewellery.

Martin Schiechtl, senior vice-president global marketing, Swarovski Created Diamonds, says, “When Daniel Swarovski founded this company in 1895, his vision was to make luxury accessible.

“Our aim is to make colour lab-created diamonds accessible to a broader group of customers, and our coloured lab-created diamonds open up new creative possibilities for our customers.”

The diamonds are manufactured and cut by Swarovski and its supplier factories. “Every supplier is audited and has to fulfill our strict quality criteria as well as environmental, safety and labour standards.

“It provides assurance to our stakeholders that responsible business practices are being followed in all sections of our operations,” Schiechtl says.

In Australia, Bolton Gems stocks lab-created colour diamonds under its Biron Lab Grown brand. Director Brett Bolton says the affordability of lab-grown colour diamonds is a win for retailers.

“Retail stores who chose to stock both natural and lab-created diamonds are appealing to a broader range of consumers, which inevitably leads to increased sales and consistent customers,” he explains, predicting a “very large shift towards lab-grown [colour] diamonds” in the next 12 months.

Trends in Colour

While much has been made of the demand for pink diamonds, other colours are also finding enthusiastic support from consumers.

“Colour diamonds across the board are performing well,” confirms Kovacs. “We’re selling a lot of bright, intense colour diamonds – yellows, oranges, and greenish-yellow – in sizes under half a carat.

“Champagne continues to be slightly more popular than darker shades, while demand for salt-and-pepper continues to be strong.”

McCreesh says O’Neils began stocking a small range of salt-and-pepper diamonds and the category has grown “significantly” over the years due to customer demand.

“As coloured gemstone merchants, we would not ordinarily stock diamonds. However, salt-and-pepper diamonds complement our gemstone range beautifully,” he explains.

McCreesh says local jewellers prefer “good, bright crystal with an aesthetically pleasing scattering of carbon inclusions” and a “well-balanced” look.

“Heavily included material is inherently dark and far less desirable, resulting in material… not suitable for the local market,” he says.

Aminov says brown diamonds, across the spectrum of hues from light to saturated, are the leading fancy colour category at Vital Diamonds. “Browns – champagne and cognac diamonds – they are the strongest [category]. We have a really exceptional collection of these goods in traditional round cut and rare fancy shapes,” she says.

Yellow diamonds have also been in demand at Vital, although Aminov notes it is not as consistent as the demand for cognacs and champagnes.

At World Shiner, Shah notes pink diamonds in all sizes are still the most popular fancy stones due to their ‘investment’ appeal.

However, he has observed different colour trends too.

“Other colours are getting more popular, like yellow, champagne, and cognac. We don’t have difficulty providing champagne and cognac diamonds to jewellers – they are still easily available compared with pink, blue and green diamonds, which are extremely difficult to source,” Shah explains.

Meanwhile, Bolton has noticed the expense of pink diamonds encourages consumers to seek alternative hues, explaining,“Most consumers are infatuated with the concept of an Argyle pink diamond. However, when they see the current prices and realise what they can afford, we find a lot of people then also look at other colours.”

Australian Chocolate Diamonds – deep, rich brown diamonds from the Argyle Mine – have fulfilled some of the demand for an Argyle stone due to stable and affordable pricing.

“We have seen many inquiries in 3-5 carat sizes as publicity around the mine closing increases and savvy investors are looking to broaden their options,” Bolton adds.

Internationally, Polnauer notes: “In larger sizes, yellow diamonds are in high demand. However, Argyle diamonds are without doubt the most sought-after stones worldwide, especially in Australia.

These beauties all want to return home!

“Unlike colorless diamonds, we have no Rapaport list to follow, so it is often challenging knowing what is in demand,” he adds.

Meanwhile, Kunming Diamonds customers are interested in pinks – in particular those from Argyle – as well as blues and colours that have modifiers, according to Maheshwari.

“Orangey-pinks, brownish-pinks, greenish-blues – these modifiers give the stone added character and personality, and are also not as expensive as a pure colour,” he explains.

“The intrinsic value of a colour diamond is in the eye of the beholder – some appreciate the colour more than the rarity factor, which can make it more popular in the market, while others appreciate the elitism and collect for the exceptionality [of a particular colour.”

In the lab-created category, Schiechtl says the “classic colours” of pink, yellow and blue have received positive feedback for Swarovski since the Color Collection launched at Paris Couture Fashion Week in January.

He adds,“People were also very excited about colours beyond the classical tones, like Neo Expressionist Pistachio (light green), Gothic Cognac (fancy deep yellow) and Heavy Metal Cherry (intense red).”

The Biron Lab Grown range includes blue, yellow and pink diamonds, with demand concentrated on “true pink, without orange overtones”, according to Bolton.

“A lot of consumers looking for pink diamonds expect them to be bright, saturated pink. That’s the colour most consumers are looking for and they are also very affordable,” he explains.

Ultimately, fancy colour diamonds – whether natural or lab-grown – offer retail jewellers the opportunity to cater to a wide variety of customers, create beautiful and unique pieces, and improve margins on diamond sales.