Are Argyle pink diamonds about to shoot up in value? As zero supply looms, what’s next for the luxury jewellery market?

The price of rare pink diamonds is expected to skyrocket as the world’s primary source – Rio Tinto’s Argyle mine in Western Australia – goes offline, so does that mean prices will increase tenfold?

May 22, 2020 Via SCMP.com

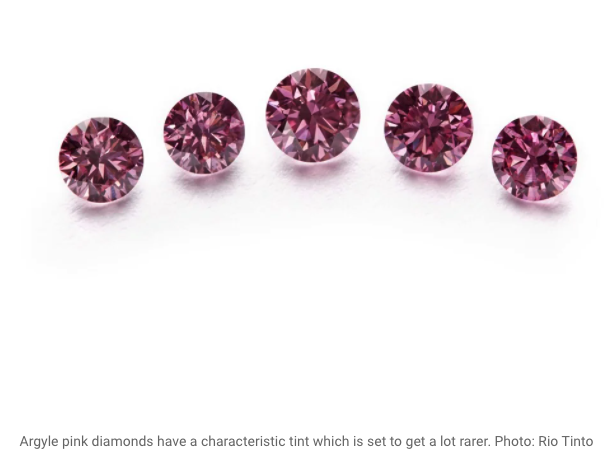

Ordinarily, a mine closure does not prompt excitement among jewellery lovers – except when it is Rio Tinto’s Argyle mine. For around 40 years the mine, in the Kimberley region of Western Australia, has dominated the pink diamond market, producing 90 per cent of the world’s supply. The closure is expected before the end of this year, affecting investors, collectors and fine jewellery buyers.

Investors buy pink or red diamonds with a view to resale and they have been amply rewarded with higher returns than equity markets. This translates to a yield of over 10 per cent each year, or 500 per cent over the past 20 years.

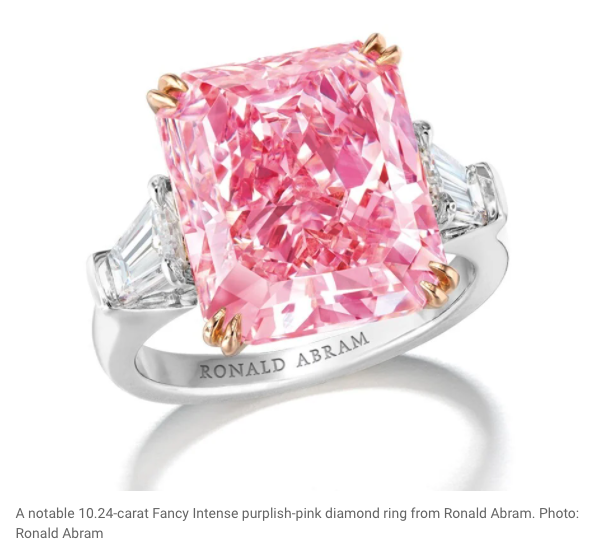

Collectors, on the other hand, do not like to part with coloured diamonds, which are rare gems of exceptional size and quality for which they pay extraordinarily high prices. Pink Star, a 59.6-carat fancy vivid pink – now the CTF Pink Star – sold for US$68.7 million to Hong Kong jewellery conglomerate Chow Tai Fook in 2017.

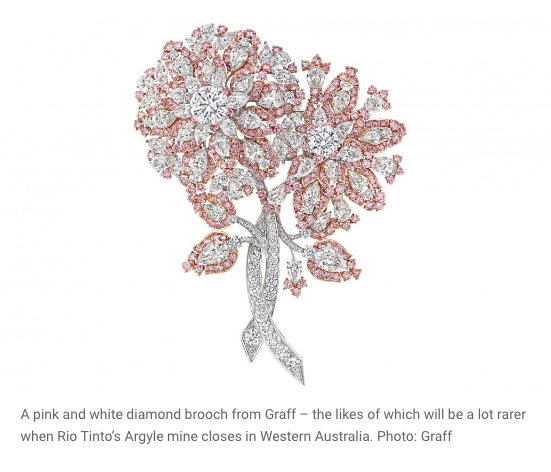

Wherever their origin, however, the pink diamond continues to be a popular choice for jewel lovers. Pink diamond jewellery by Graff, Harry Winston and Ronald Abram continues to be eagerly sought year after year. With the production of the Argyle mine down to zero, demand and prices show no sign of dropping.

There are, however, repercussions for jewellers and their clients. Each year Rio Tinto hosts a highly secret tender, inviting sealed bids from selected buyers. The 2019 Argyle Tender featured pink and red diamonds highlighted by six gems of 1.07 to 2.01 carats. This seems laughably small by white diamond standards but for coloured diamonds it is a splendid selection.

Since it is a universal truth that people want what they cannot have, the drastic reduction in supply may have triggered an upsurge in demand. Harsh Maheshwari, director of Kunming Diamonds, notes that since the second half of 2019 a number of jewellers have reported a level of requests for Argyle pink diamonds which they had not seen previously.

“Since early February, the global diamond industry has been adversely impacted,” he says. “However, with the imminent closure of the Argyle mine, and the rarity of such beautiful gems, Argyle pinks have been insulated in this environment.” In the current economic climate, that is no small thing.

Maheshwari speculates that in these economically unstable times, investors might be seeking alternatives to the stock market.

Hong Kong’s Kunming Diamonds was successful in acquiring an historical collection showcasing 64 box sets of premium Argyle pink diamonds in the rarest saturated spectrum, called The Everlastings Collection. Two of the “hero” stones of the last tender, the 1.75-carat fancy red Argyle Enigma, and the Argyle Verity, a 1.37-carat fancy vivid purplish-pink, were acquired by Blue Star & Kiven Diamonds.

Ron Kiven, director, says, “With the closure of the mine imminent, and the fact that over 90 per cent of the world’s pink diamonds come from this one mine, there is no doubt that demand will rise as people will be pre-empting a zero supply.” He notes, however, that there has always been difficulty in satisfying demand, even while the mine was in production.

Both Kiven and Maheshwari cite the advent of the coronavirus, and the resulting economic uncertainty, in the context of how much consumers can expect to pay now and how much return investors can expect. Will the upwards trajectory of pink diamond prices be maintained?

“I don’t have a crystal ball and the current world situation is unique,” Kiven says, “but if we look at the speed of the price rises over the last 10 years, for instance, it has been a very high performing investment.

“Since the Argyle pink diamonds have been analysed in terms of pricing they have never reduced in price and in last few years the speed of increase has been amazing. Again, one can only use logic in terms of a limited supply of a highly sought-after product now ceasing to produce at all. It aligns itself to a fine artist whose works are sought-after but who no longer produces new pieces.”

The other 10 per cent of pink diamonds come from Canada, Botswana, Brazil, South Africa, Tanzania and Russia, but it is the Argyle diamonds which carry a premium.

The only other pink diamond supplier with a high international profile is the Russian firm Alrosa, capitalising on the publicity around its fancy vivid purplish pink Spirit of the Rose, a 14.83-carat blockbuster, potentially valued at more than US$60 million.

Alrosa is keen to pick up the slack left by Argyle’s departure. The company says two of its developments in Russia are yielding coloured diamonds and it could potentially satisfy up to 30 per cent of market demand.

The last word, however, should go to Maheshwari: “The properties of an Argyle pink are unmatchable.”