Ellendale discovery provides hope for Australian diamond industry, as Argyle closure looms

West Australian diamantaires and jewellers are hopeful they are one step closer to accessing a new source of coloured diamonds in the Kimberley, following a significant discovery at the Ellendale diamond field in WA’s far north.

Via ABC.net – By Courtney Fowler

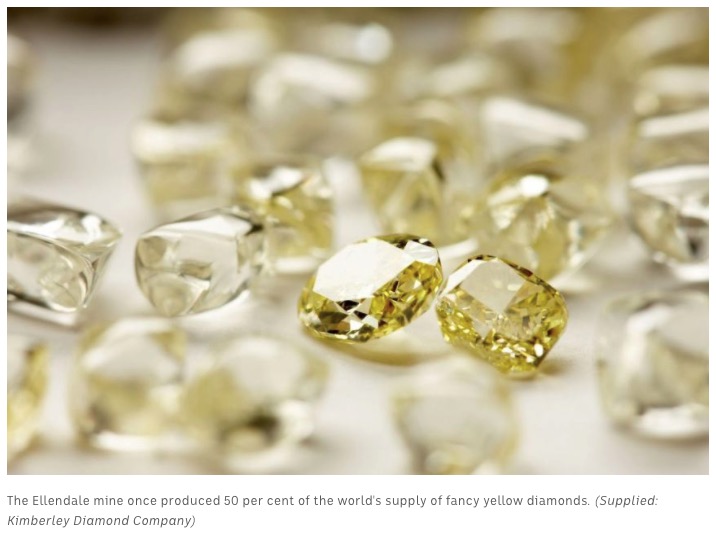

Earlier this month junior explorer India Bore Diamond Holdings revealed it had unearthed a large alluvial deposit of rare diamonds on a site near Derby, which once produced half the world’s supply of fancy yellows.

Exploration at the mothballed Ellendale lease kicked off in May after the State Government invited two companies to apply for tenements through an expression of interest process in 2019.

Previously, India Bore had been drilling and bulk sampling in an adjacent diamond field, where commercial diamond grades were recovered and evaluated by leading Antwerp-based diamantaires.

The company is targeting an ancient buried river system, known as the L-Channel, that formed some 22 million years ago and is estimated to contain at least 1.3 million carats of gem-quality diamonds.

Rare fluorescence being studied

Director Patrick Stringer said India Bore was encouraged by an independent study of the diamonds recently recovered, which revealed many of the stones displayed a purple fluorescence under ultraviolet light.

The ongoing study, by Perth-based Delta Diamond Laboratory, is looking at the relationship their fluorescence and the origins of the Ellendale signature yellow colour.

Diamond scientist John Chapman said natural fluorescence only occurred in about 30 per cent of diamonds, a characteristic rarely seen in fancy yellows.

“Violet or purple fluorescence is normally associated with blue diamonds, so the fluorescence of these IBDH diamonds is quite unusual”, he said.

Finding more coloured diamonds

The discovery comes as the diamond industry grapples with the looming closure of Australia’s largest operational diamond mine at the end of this year.

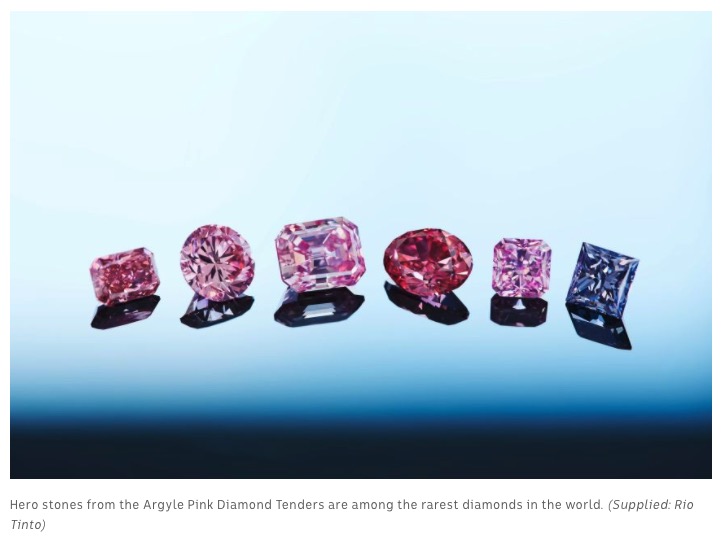

Rio Tinto’s Argyle mine, 3,000 kilometres north of Perth, produces more than 90 per cent of Australia’s diamonds and is one of the few known sources of pink diamonds in the world.

Linneys Jewellery chief executive and diamond consultant David Fardon said as production wound up at Argyle, all eyes would be on Ellendale as the industry looked for the next big source of coloured diamonds.

“Historically there’s been some beautiful yellow diamonds produced out of the Ellendale mine, so any opportunity for further discoveries in that area is certainly of interest to the jewellery business,” he said.

“With the closure of Argyle, you’re really losing the major principal supplier of pinks … so certainly the yellows provide another opportunity to further explore fancy coloured diamonds.

“The timing of it fits nicely, as we’re going from one chapter to the next.”

Mr Fardon said, historically, the Ellendale yellows had been popular with Australian consumers, and international brands like Tiffany & Co jewellery had brought the product to a global market.

He said fancy yellow diamonds were typically valued at two-to-four times the price of a white diamond of a similar size and quality.

“To put that in context, when you’re looking at something similar in pink you could be looking anywhere these days between 25-50 times the price,” Mr Fardon said.

“So, they’re not quite in the same price stratosphere as what pink diamonds are, but they certainly are scarce, and the value is reflective of that scarcity.”

Exploration brings new life to Ellendale

The WA Government has spent about $230,000 on rehabilitating Ellendale mining lease and making it ready for new operations.

The previous operator Kimberley Diamond Company went into administration in 2015, relinquished its lease and environmental liabilities — reportedly up to $40 million — back to the State Government.

Mines and Petroleum Minister Bill Johnston said he was optimistic renewed investment in the Ellendale operation, could help rejuvenate the Kimberley diamond industry.

“With the current decline of Rio’s operations in the Kimberley, the opportunity to have Ellendale come back in production would make it very significant,” he said.

“India Bore Diamond Holdings seem to have found some exciting opportunities with these vivid coloured diamonds.

“I think it’s exciting news for the Kimberley; it shows there’s probably more diamonds to be found and hopefully they can be found in a commercial quantity that allows the mine to develop over time.

“Continued investment will create jobs and opportunities for indigenous people as well as other residents in the Kimberley.”

Gibb River Diamonds, who have been exploring on the adjacent Blina pastoral lease, have also started pegging leases at Ellendale.

The company already holds mining and exploration leases over 40 kilometres of diamond-bearing alluvial channels west of Ellendale, where trial mining is scheduled to begin this year, once financing is complete.

Will there ever be another Argyle?

Mr Fardon said although the renewed exploration efforts in the Kimberley were encouraging, he doubted there would ever be a diamond mine that could equal the success of Argyle.

At its peak production, the mine produced a quarter of the world’s diamond supply, and when Argyle shuts down, it’s been estimated global diamond production will drop off by 10 per cent.

But the real loss will be the unique source of vivid pink diamonds.

“The Argyle pink diamonds are the rarest and most special of all the fancy coloured diamonds,” he said.

“The pinks and purplish-pinks certainly are in a league of their own.

“They’ve become much sort after, and it will be a sad day when the mine comes to an end but at the same time it’s been very exciting to be associated with such a special product over the last 30-35 years.”