Argyle Closure Proves That Diamond Mines Are Not Forever

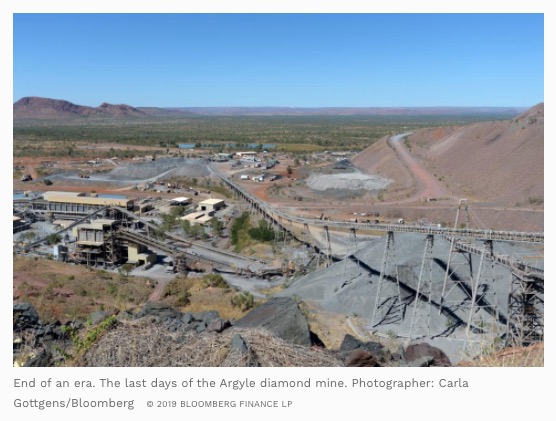

A diamond might be forever, as the famous advertising slogan from De Beers claims, but a diamond mine certainly isn’t, as the closure this week of the once-giant Argyle mine in Australia proves.

via Forbes.com – Images Copyright

At its peak, Argyle was easily the world’s biggest single source of diamonds, producing 42.8 million carats in its peak year of 1994 and 865 million carats in its 37 years of continuous operation.

But a combination of rising costs as the mine deepened, flat diamond prices and a low average price per carat sealed Argyle’s fate leading to a decision by its owner, the Anglo-Australian mining giant, Rio Tinto, to close the gates.

Always a product where emotion overrides hard-nosed accounting the final days of diamond production at Argyle have been marked by farewells and fond memories, but it wasn’t ever easy going for a difficult mine in a remote location producing generally poor-quality diamonds.

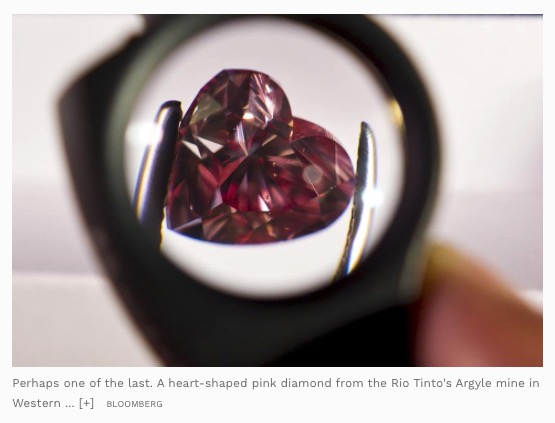

Most Argyle publicity, and the image Rio Tinto wanted, was of a mine which yielded the bulk of the world’s pink colored gems which attracted huge prices such as the Pink Star which reportedly sold for $71.2 million in Hong Kong in 2017.

Pink diamonds, however, are not unique to Argyle and while they became the mine’s trademark the reality was the the bulk of the diamonds mined were classified as industrial and used as a grinding medium or in drill bits, with low-grade gems destined for use in cheap jewelry. Finding a high-quality pink stone was a rare event.

Only about 5% of Argyle’s output was classified as gem but that small percentage of production also generated the lion’s share of profit which, in some years, was difficult to generate.

Just how tough the diamond business has become was revealed in Rio Tinto’s last full-year profit result when gross revenue from the Argyle mine, and a majority stake in Canada’s Diavik mine, declined by 11% to $619 million resulting in an overall loss of $21 million from diamond operations.

While the official history of Argyle will be a glowing account of discovery in the rugged hill country of Australia’s north-west Kimberley region the reality is somewhat harsher, starting with the problem that Argyle was a diamond “orphan”.

Despite decades of searching, Rio Tinto failed to find another commercially viable source of diamonds with the closure of Argyle ending Australia’s role as a significant producer of diamonds.

Argyle was also the cause of an acrimonious relationship between Rio Tinto, a business best known for its mining skills and De Beers, the long-term leader of the diamond business with a deep knowledge of marketing.

Bruised Relationship

In its early days the two companies worked closely with Rio Tinto selling the bulk of Argyle’s output through De Beers, until that relationship broke down over disputed valuations leading to Rio Tinto setting up its own marketing operations.

De Beers was not impressed, ensuring that the diamond cutting industry of India, where the bulk of Argyle stones are processed, was well supplied when Rio Tinto launched its own range of stones, a move which caused a short-term crash in the price of low-grade stones.

It was, effectively, De Beers firing a warning shot across the bows of Rio Tinto, perhaps trying to force Argyle back into the De Beers family.

Rio Tinto countered with its own marketing campaigns which focused on high-value pink gems which attracted high prices as well as an attempt to build demand for dark and light brown gems, which proved less successful especially after the darker stones were dubbed “beer-bottle browns” by an unkind journalist.

The end of Argyle closed a chapter in Australian mining, and might even be the end of the book.