‘The new Faberge egg’: Pink diamond prices set to soar as Australian mine producing 95% of the world’s supply prepares to close forever

- World’s largest pink diamond mine is closing – it has run out of fancy pink stones

- Argyle pit in WA’s Kimberley is getting too deep to dig beneath and extract gems

- Mine supplied more than 90 per cent of world supply is closing

- Argyle pinks will be like the ‘Faberge eggs’ in a decade, jewellery historian says

- Rio Tinto operations director says Argyle pinks rose five-fold over past 20 years

By ALISON BEVEGE FOR DAILY MAIL AUSTRALIA

The price of pink diamonds is expected to soar after the Argyle Diamond Mine which produced nearly the entire world supply closes this week.

The world’s largest pink diamond mine began when a group of geologists stumbled across a stone in the Kimberley region of Western Australia in the 1970s.

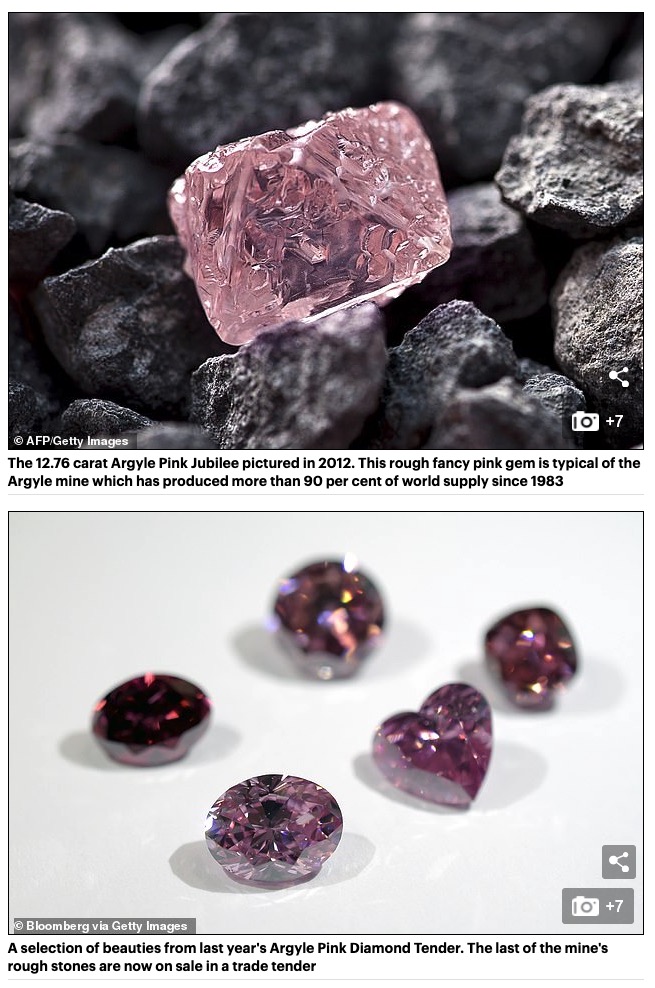

Since owner Rio Tinto began production in 1983 the mine has produced 95 per cent of the world supply of the rare diamonds.

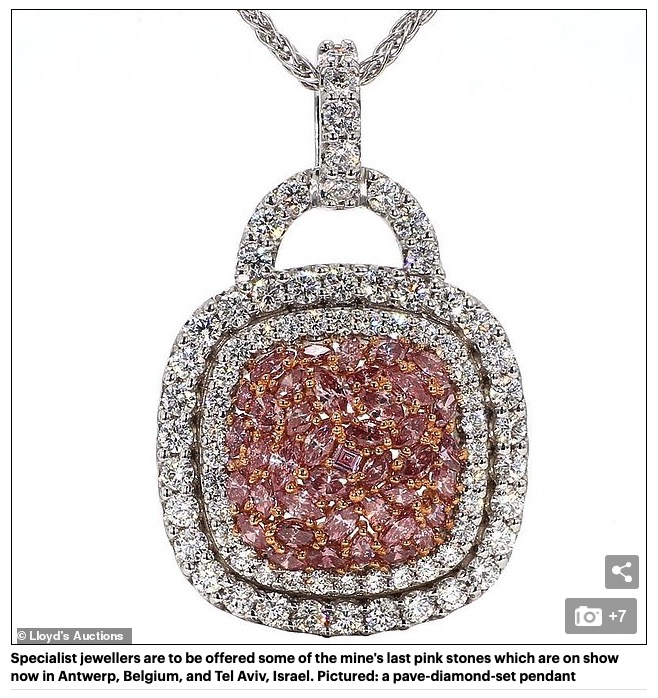

Twinkling from rose through magenta to purple, the stones have commanded some of the diamond market’s highest prices.

Some diamond colours are caused by trace elements such as nitrogen (yellow) or boron (blue), but pink diamonds have not been found to have trace elements.

Instead, scientists believe the pink hue comes from a distortion in the crystal lattice caused by intense heat and pressure.

The pink stones have accounted for less than 0.01 per cent of Argyle’s total output, with the mine producing more than 865 million carats of rough diamonds over its life.

In 2019, Argyle employed 373 people and produced 12.9 million carats of gems.

Most of the diamonds mined at Argyle are browns of which only 5 per cent are gem quality, however it has consistently produced high-quality pink diamonds making it a unique deposit.

But Rio Tinto has decided to close the mine as the supply of pinks is running out and the it is now too deep to excavate beneath and extract them.

‘The drilling costs are growing, and profits deriving from the diamonds produced are not enough to cover operation costs,’ subsidiary retailer Argyle Diamond Investments said on its website.