Pent-up jewelry demand has lifted the gems’ valuations while online sales have grown

Via The Wall Street Journal, written by Will Horner

Diamond prices have rebounded from a coronavirus-driven slump thanks to the reopening of some economies in Asia and strong jewelry sales around the world over the holiday period.

Polished diamond prices are up 5.1% from their lowest point in March, putting them at their highest level in nearly a year and a half, according to a gauge compiled by the International Diamond Exchange.

The pandemic dealt a big blow to the diamond industry last year, with every link in the supply chain—from Russian miners to India’s diamond cutters to luxury boutiques in New York—being closed or seeing activity curtailed.

But demand for diamond jewelry has been steadily recovering since retailers began reopening last summer in Asia, tentatively followed by elsewhere in the world, analysts said. With international vacations on ice and restaurants in many parts of the world still closed, wealthy individuals are buying diamonds with surprising voracity.

Polished diamond-price index

Because diamonds come in a variety of shapes, sizes, colors and qualities, the industry lacks a benchmark price. But market watchers say both rough, mined diamonds and polished stones bought by consumers have seen their prices approach pre-pandemic levels.

A one-carat polished diamond of slightly above-average quality currently sells for $5,900, Mr. Zimnisky said. That is up 14% from a low point in April, while an equivalent rough diamond rose 18% in that time, he said.

Prices popped in December, thanks to strong holiday sales and pent-up demand that built during lockdowns. December is typically a strong time, with jewelry sales normally rising around 120% from November, said Edahn Golan, who runs an Israel-based diamond-market research firm. This year they jumped 160%, he said.

Still, the pandemic’s impact on jewelry sales hasn’t been uniform. Sales of diamond stud earrings saw the largest year-over-year growth of all jewelry categories in 2020, Mr. Golan said, as the desire to look good in video calls boosted demand for adornments worn from the shoulders up.

The pandemic also pushed the industry to embrace new technology at a faster rate. Before lockdowns, retailers were skeptical that consumers would be prepared to buy expensive diamonds online. But strong take-up for internet offerings has helped diamond sales recover while modernizing some businesses.

“It has forced our industry to go to a place that we have been slow to get to,” said David Kellie, CEO of the Natural Diamond Council.

The diamond market has fewer gauges of global demand than other, more widely traded commodities, presenting special challenges for analysts.

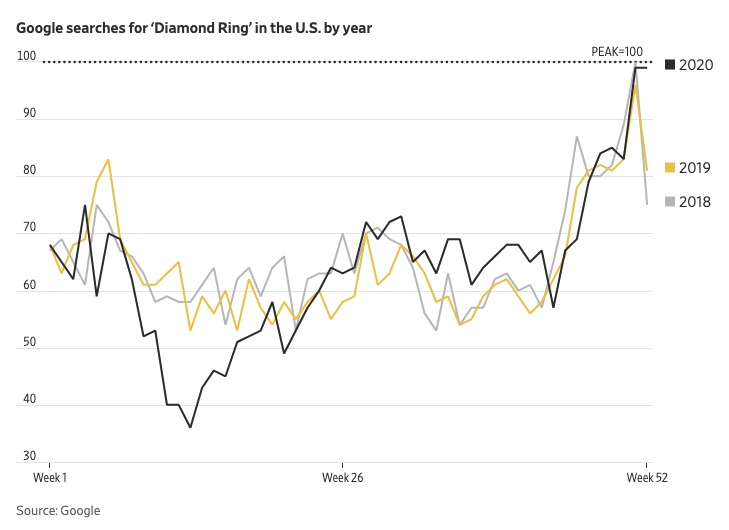

Google searches for “diamond ring” in the U.S., the country that accounts for around 50% of the world’s diamond consumption, can be a good proxy, said Kirill Chuyko, head of research and mining analyst at Russian brokerage BCS Global Markets. Searches for the term slumped in March but have since recovered to prior levels.