From birth to timeless legacy: The complete story of Argyle pink diamonds

By Arabella Roden • Editor Via Jeweller Magazine

As the era of the Argyle Mine draws to a close, ARABELLA RODEN explores the compelling history and enduring legacy of the world’s premier source of pink diamonds.

The colour pink is associated with many things – beauty, love, and femininity, to name a few. And so too are pink diamonds, which in addition to their captivating colour, are also some of the rarest treasures on Earth.

There is no way to discuss the pink diamond category without the Argyle Mine. Discovered in 1979 and operational since the mid-1980s, the Rio Tinto owned-and-operated site – located 550km southwest of Darwin, in the remote Kimberley region of Western Australia – produced 90 to 95 per cent of the world’s pink and red diamonds before its closure in November 2020.

Yet those numbers, while impressive, almost seem to belie the true miraculousness and scale of the project.

Measuring approximately 50 hectares, with a depth of 600m, the Argyle Mine was at one point the largest diamond mine on Earth.

Visible from space, it nearly doubled the world’s diamond output in the 1980s and ’90s; by 1986, it had made Australia the world’s leading diamond producer, according to the Gemological Institute of America (GIA).

Professor Stuart Kells, author of new book Argyle: The Impossible Story of Australian Diamonds, tells Jeweller, “There were so many things that were unprecedented in this story, and one of them was the size of the deposit. At the time, it was equivalent to all of the other major diamond mines combined. The scale of it is incredible; you don’t get a sense of it from photos.”

He adds, “The discovery itself was difficult; using helicopters and small boats in a remote part of Australia, searching for diamonds in an area where they hadn’t been found before. That was the first challenge.

“There were a few false starts, such as finding the Ellendale field which proved to be uneconomic. It was a bleak time before they found the actual deposit, with this incredible concentration of diamonds. Almost straight away there were claim-jumpers who tried to snatch the rights to the deposit,” says Prof Kells.

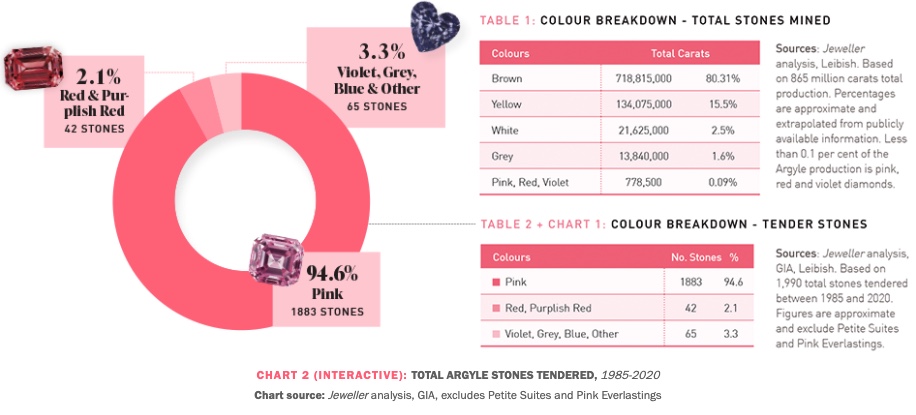

While an estimated 72–80 per cent of Argyle’s 865 million- carat output was brown stones – branded as ‘champagne’, ‘chocolate’, and ‘cognac’ diamonds – its most enduring legacy is as the home of the world’s most vivid reds and pinks, which made up less than 1 per cent of its output.

“Even though Argyle produced virtually the entire world’s supply of pink diamonds, the volumes were extremely small; a year’s production would fit in a single Champagne flute,” Patrick Coppens, general manager – sales and marketing, Rio Tinto Copper & Diamonds, tells Jeweller.

“They are beyond rare – and from one of the most beautiful and remote places on earth, the East Kimberley region of Western Australia.

“Additionally, there is no other natural fancy coloured diamond that possesses the colour saturation and the colour palette. Their natural beauty has an almost instant and global appreciation akin to fine art. Indeed, each Argyle pink diamond is a work of art,” Coppens adds.

Indeed, Argyle pinks have their own unique colour grading system.

Alan Bronstein, president of the Natural Color Diamond Association (NCDIA), explains, “The allure of Argyle pink diamonds is that the finest ones have unique hues and saturations, which predominate this specific locality. Until 37 years ago, such deep pink colours in natural diamonds were rarely seen.”

He adds, “There are examples of similar colours from other mines in the world, but Argyle has given some connoisseurs the opportunity to own this rare specimen of Earth’s geology. What they lack in size compared to other natural fancy colour diamonds, they make up in their captivating visual allure.”

There are other appealing aspects of these diamonds too, says Steve der Bedrossian, CEO SAMS Group, which supplies loose Argyle pink diamonds as well as Pink Kimberley and Blush Pink Diamonds jewellery brands.

“Argyle pink and red diamonds display unparalleled colour – those strong hues – and of course there is their rarity. They are also ethically mined here in Australia, and each one comes with an Argyle certificate that guarantees its origin,” he explains.

LJ West Diamonds has been an Argyle Authorised Partner for more than 30 years and has amassed the largest collection of Argyle pink diamonds in the US.

LJ West vice-president Scott West, son of founder Larry West, tells Jeweller that his father became “hooked” on the diamonds after purchasing his first parcel of Argyle pinks around 1990, following a visit to the mine itself.

“Once back in New York, Larry brought the diamonds to a buyer who was a maven in rare colours. Larry knew from past negotiations with this customer that the person would always bring out comparable stones in order to negotiate down the price.

“This time, however, the customer did not have any comparable stones,” West says.

“This time, however, the customer did not have any comparable stones,” West says.

“Larry could see he desperately wanted to purchase the goods since they were unlike anything he had – it was then Larry was hooked, and LJ West Diamonds has never looked back!”

Michael Neuman, director of Mondial Pink Diamond Atelier in Sydney, which is one of less than 40 retailers worldwide to bear the Argyle ‘Select Atelier’ designation, tells Jeweller, “Argyle was the world’s only reliable source of beautiful pink diamonds ever in history.

“For those of us who have been working with them pretty much since the mine began, they are also incredibly special because they are a unique Australian gift to the world – the apogee, pinnacle, exemplar of their kind.

“There are only a handful of things from Australia that are so treasured throughout the world.”

It’s a sentiment echoed by Harsh Maheshwari, director of fancy colour diamond supplier Kunming Diamonds, which began stocking Argyle pinks in 2011.

“An Argyle pink is special because it gives you the experience of Australia, and of the Argyle Mine. Pink diamonds were the country’s ‘hidden gem’ up until 37 years ago and Argyle has achieved the status of the pinnacle in the diamond chain – ultra luxury diamonds.”

He adds, “Beyond their appreciation in value over the past few decades, Argyle pink diamonds seem to radiate special emotions. Each one takes the form of Earth’s hardest substance, a rare mineral by nature, and in the most beautiful and appealing colour – pink!”

Another Select Atelier, John Calleija, praises the diamonds as “ancient treasures”: “They are 1.6 billion years old, they were formed 160km beneath the Earth’s surface in the East Kimberley region of Western Australia, and nowhere else in the world will you find diamonds with such an intensity and range of colour,” he says.

The magic of pink

In the world of fancy colour diamonds, pinks stand apart – partially as a function of rarity and beauty, but also as a result of shrewd promotion. Given that pink is a colour associated with love, life and beauty, and represents everything from a budding spring blossom to the blushing cheeks from a first kiss – everything that we want to cherish for eternity – it hasn’t been difficult to market.

“Pink diamonds always seem to have a little more consumer curiosity because they are the most advertised and promoted of all the different colour diamonds,” explains Bronstein.

“Other colour diamonds go through moments where they are ‘commercial fads’, and demand ebbs and flows with promotions and designers creating new pieces.”

He adds, “Yellow diamonds are easily accessible and affordable in larger sizes than pinks, but they have not been fully marketed to the public. Blue diamonds are even rarer than pinks, meaning they are not affordable to most. Therefore, they are rarely promoted or marketed, except via special auctions.”

Among the exclusive pink club, Argyle pinks rank above all. Rio Tinto estimates that Argyle pink diamond prices have appreciated by 500 per cent over the past 20 years; overall pink prices rose 116 per cent between 2009 and 2019, according to the Fancy Color Research Foundation (FCRF).

US-based fancy colour diamond supplier Leibish first participated in the Argyle Tender in 2010.

Director Leibish Polnauer tells Jeweller, “Pink diamonds have fared better than all other fancy colours [in terms of prices], but Argyle pink diamonds have had a real boom, with exceptional increases. The strongest price moves we noticed are in Argyle red diamonds, and we have a few in stock.

He added, “The money we needed to spend on the Tender is about seven times higher than 10 years ago. Argyle diamonds were always considered rare and valuable, long before the news of the mine’s impending closure was announced.

“Although Rio Tinto worked exceptionally hard unearthing as many diamonds as possible, demand has constantly outpaced the supply.”

Yet, in the early years of Argyle, there was a distinct lack of awareness around pink diamonds due to the sporadic supply. It is estimated less than 2 per cent of diamonds display noticeable colour, and less than 1 per cent of those diamonds are pink or red.

“Construction on the Argyle Mine commenced around 1984 and it gradually gained attention, but it wasn’t until Brisbane hosted The World Expo in 1988 that we saw a strong increase in enquiries [about pink diamonds],” says Calleija.

“This six-month event attracted more than 15 million visitors and fortunately Argyle shared news of their pink diamond discoveries for everyone to see.”

Adds Neuman, “In the 1980s, our parent company was one of two distributors for Argyle diamonds on the east coast of Australia.

“My first job was to go all around the country and try and sell pink diamonds to jewellers – it was a fairly new thing, and it was difficult to get most jewellers to appreciate the value in a pink diamond.

“But as time went on, it started to take off as more jewellers took up pink diamonds, advertised and promoted them.”

Trends in Demand

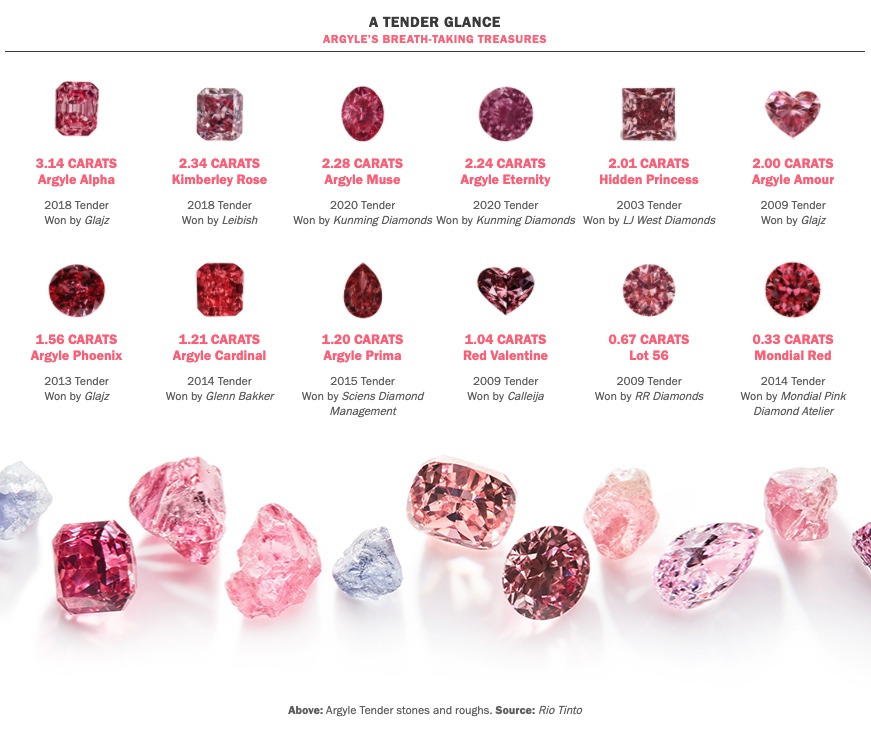

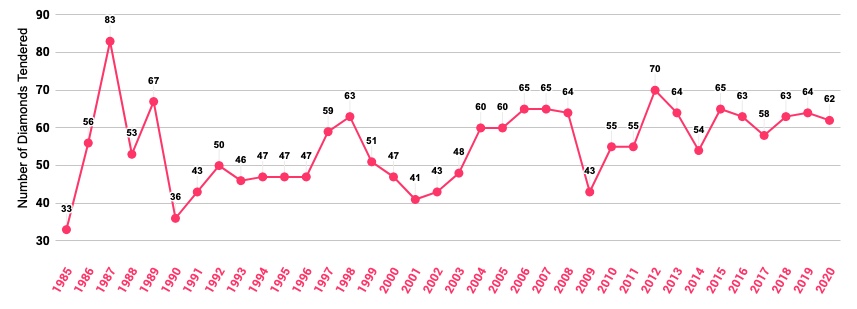

Perhaps the most important factor in the marketing of Argyle pink diamonds was the annual Argyle Tender, introduced in 1984 with a special viewing of 33 diamonds in Antwerp.

It has since expanded to include viewings in Geneva, London, Sydney, Tokyo, and Perth, with some Tenders including more than 70 stones.

In a 2014 GIA retrospective to mark the Tender’s 30th anniversary, authors John King, Dr James E Shigley, and Claudia Jannucci noted the mystique of the process: “Argyle’s Tender process only adds to the excitement that surrounds these diamonds. The Tender is by invitation only, and the list of invitees is not made public.

“An invitation to view allows a time slot of approximately one hour in which to make bidding decisions.

“Despite this time constraint, the participants are seasoned professionals who know the range of pink diamond color appearances and how they relate to value. In any given city, the site remains unknown until just before the viewings,” they wrote.

Over the decades, approximately 1,990 diamonds have been offered at the main Tender, of which more than 90 per cent were pink. A smaller, private tender for selected suppliers also takes place in March.

Reflecting on decades of Tender participation, West tells Jeweller, “We have Tender books dating back to the ’90s. It’s amazing to see the difference in how the stones were presented then – and the tiny prices we bid when purchasing them!”

“We participated in the very first Tender from Argyle and have participated in every Tender subsequent,” says Mondial’s Neuman.

“We haven’t always been successful in our bids, but that’s more a function of how we bid and everybody else. We tend to purchase for stock, therefore we look very carefully at the items we bid on.

“We want them to be uniquely special – stones with certain characteristics that make them stand out from even the other Tender diamonds.”

The announcement of the mine’s final closure date led to a spike in demand across the board.

Maheshwari said the announcement “created hype to a different level”: “Even during the pandemic, the prices and demand were not affected, and they have started to appreciate drastically since mid-2020.

“Argyle pinks have become irreplaceable, and the increased ‘connoisseurship’ of Argyle pink diamonds has triggered a chain reaction that has sent prices for all categories into the clouds.”

Ronny Rosenthal, director of diamond supplier RR Diamonds, shared similar observations: “The demand has always been strong, but with the news of the mine’s closure, it exceeded expectations both domestically and internationally.

“I think collectors and jewellery lovers were the original drivers of demand. More recently, the investor buyer has played a role and there have been areas of the market that catered to that.

“However, importantly, there are also buyers that want to take part and have a piece of this unique moment in the history of Australian gemstones. There’s a lot of pride in this product.”

Adds Polnauer, “Round stone prices reached explosive heights and it is nearly prohibitive to plan jewellery with round Argyle melee diamonds, as they cost more than the centre stone!

“Argyle stones over one carat are also in great demand and hardly available. We bought six stones over 1 carat at the 2020 Tender.”

Argyle Assets

John Glajz, director of Singapore-based pink diamond specialist supplier Glajz, told Jeweller, “We noticed a substantial increase in demand in late 2019, once Rio Tinto made the official announcement of the mine’s closure date as November 2020.

“We had known all along that the production would cease eventually, however the announcement put a finite ‘line in the sand’.”

He added, “Our company has participated in Argyle Premium [March] and Signature [main] Tenders for more than 20 years. We actually purchased the entire single premium tender of 71 diamonds in April 2020, on the eve of the COVID-19 lockdowns in Singapore and Australia.

“I must say that I was temporarily concerned having made such a level of financial commitment, as the world was running for cover and international business suddenly ceased to exist.

“Fortunately, this was only a temporary phenomenon and the demand surged shortly afterwards!”

Glajz said consumer demand in 2020 came from both jewellery collectors and investors, and was amplified during the pandemic: “The demand from jewellery collectors was impacted by the cessation of international travel.

“The product was strongly promoted by leading jewellers both in Australia and internationally as a thing of beauty, Earth’s treasure, the ultimate collectible, and an exclusive, everlasting gift of love,” Glajz explains.

On the investor side, he notes, “[Argyle pink diamonds were] also aggressively presented by several non-jeweller companies as an ‘asset class’ and even as an alternative investment [to more traditional investment vehicles such as stocks and property] in order to appeal to a wider market.

Glajz adds,“One could draw a parallel with the fine art market; there are the buyers who purchase art for the simple love or decorative merits of the piece, and others who purchase for the perceived potential store of value and an eventual return on their investment.”

Neuman first noted the rise in ‘investment diamond’ buying following the Global Financial Crisis of 2008; according to the FCRF’s analysis, pink diamond prices saw the most dramatic increase between 2009 and 2014.

“The GFC didn’t really affect Australia as much as it affected the rest of the world, but many people were poorly affected in terms of investments in the stock market.

“People started to look at pink diamonds as part of the portfolio for their self-managed super funds. Around that time – 2008-2010 – was the first major, or boosted, period of growth for pink diamonds prices,” Neuman says.

He adds, “We’ve seen a second wave in the last five years as some sellers of pink diamonds have targeted the investment angle.

“They are particularly focused on trying to highlight the growth in the cost of pink diamonds as an indicator that they would, perhaps, be a worthwhile alternative for people looking to channel some of their investments away from the more traditional areas, given the low-yield environment.”

Der Bedrossian noted a definite acceleration of demand around 2010. “There was more momentum at that point, when there was talk of closing the mine altogether before Rio Tinto decided to continue mining underground [in 2013].”

Today, SAMS Group sees “a healthy blend of both” jewellery lovers and investors purchasing pink diamonds.

“Per piece sold the demand is higher for jewellery, but in terms of dollar value per item, it is definitely more from the investor/collector side,” he tells Jeweller.

Calleija puts the current demand split at 80 per cent jewellery lovers, and 20 per cent investors.

“As they say, ‘Supply creates its own demand,’ and the rarity of Argyle diamonds has increased significantly with the closure of the Argyle Mine.

“This has resulted in a strong increase in their value and interest among jewellery lovers and collectors,” he says.

With the closure of the Argyle Mine at the end of 2020, one question remains on everyone’s lips – where do we go from here?

The last Argyle Tender is scheduled to take place later this year, with Coppens calling it, “a final-in-a-lifetime event, a moment in time to acquire the last production of the most special diamonds produced in the last months of an iconic mine”.

“We are excited that the Argyle Mine continued to produce these wonders of nature even during the final days of the mine’s life, including a number of very special diamonds,” he tells Jeweller.

“We are currently curating the final collection of diamonds for inclusion in the 2021 Tender and are looking forward to showcasing them to a global audience. These are earthly treasures, in a league of their own and bidders will not be disappointed!” he adds.

Says Neuman, “We still have yet to see the production from that last ore being extracted from the mine in November last year – that hasn’t come through to the market, but it is imminent.

“That will be the last of the new Argyle pink diamond material. Once that’s done, there will be the remaining stock that is already held by Argyle Pink Diamonds Authorised Partners and pink diamond stock that is not in private hands and is ready to be sold. That will be sold over the next 12 to 24 months,” he predicts.

Glajz tells Jeweller, “I think that the general demand will continue and gradually flatten. The recent spike in prices has already created some consumer resistance, but prices will most likely remain robust as existing inventories are sold down.”

Other suppliers agree that the demand for pinks is unlikely to abate soon, and with supplies dropping to a tiny fraction of what they were when Argyle was productive, prices will inevitably rise.

“The market is extremely strong at the moment, and it’s just going to get stronger,” says Der Bedrossian.

“The prices are going to keep going up as there are simply no more stones coming from Argyle. I’m sure there will be some stones arriving on the market from investors who want to ‘cash out’, but this is not going to be a consistent supply – certainly not as consistent as what Argyle has spoilt us with for the last 35-plus years!” he adds.

Meanwhile, Maheshwari explains, “A secondary market for Argyle pinks is already in play and will take over in the next few years – that will remain as a significant source.

“Parallel to that, pink diamonds are being sourced from Brazil, Russia, and various African mines. Theoretically and historically, prices jump and then only gradually appreciate over time.”

Adds West, “Once diamonds go into private hands, they re-enter that market at slow rates so we think its safe to assume the supply of Argyle pinks held by diamond companies will continue to decrease as time moves on and that will increase the price people want for their remaining stones.”

Bronstein observes that the industry must continue to support the pink diamond market.

“Much of the added-value concept for pink diamonds has been driven by the Argyle awareness. This education and promotion must be maintained. There are already creative marketers coming out with new ideas to capture the untapped customers,” he says.

Russian mining conglomerate Alrosa – the world’s largest diamond producer by volume – has unearthed several notable pinks in recent years, including the 14.83-carat fancy vivid purplish pink it named ‘Spirit Of The Rose’. It was sold in November 2020 by Sotheby’s for $US26.6 million.

Colour diamonds currently account for less than 0.1 per cent of Alrosa’s total output and most originate from the remote Yakutia region in Siberia, like Spirit of the Rose.

LJ West purchased its first Yakutia pink diamond in 2020, with Scott West telling JCK Online at the time, “Siberia has a lower quantity [than Argyle] but is still a somewhat consistent production… [And] because Siberia is so big, there is the potential to find new mines.”

In Botswana, mining company Lucara unearthed a 4.13-carat pink at its Karowe Mine in 2019, and recently had its mining licence renewed by the Botswana government until 2046.

Neighbouring Lesotho has also been a source of pink diamonds, with Gem Diamonds unearthing two large specimens – a 14.09-carat and a 13-carat – from the Letšeng Mine in 2020.

However, West clarifies, “Pink diamonds are found in Africa and Russia but make up less than 10 per cent of the current world supply, which during the peak Argyle days was still not many stones.

“African and Russian pinks are also different in appearance, so if a person is looking for the strong raspberry tones Argyle is known for, they will have to look for old Argyle stock.”

In Australia, Lucapa and GeoCrystal are part of a handful of parties involved in Australian diamond exploration, though no pink diamonds had been unearthed at the time of publication.

Calleija says discovering another mine to equal Argyle is unlikely: “Decades of research go into finding the right environment that actually has diamonds and then it takes many more years of investigation to find out if the area can be mined.

“To discover pink diamonds like this again is highly unlikely. Many expect this is the last generation to experience the privilege of mining pink diamonds.”

Viewing the market from a holistic perspective, Bronstein says, “The closing of any mine, especially one that is the major source for a particular colour, has an effect on the future market.

While no new stones will be coming from the mine, what has been extracted still gives many options to those seeking a fabulous stone.”

“There is no question that the beauty and rarity of the finest Argyle pink diamonds will always be appreciated by traders, collectors, and connoisseurs, but where the values will settle is impossible to predict.”

As for the Argyle Mine itself, Rio Tinto is currently undertaking decommissioning and rehabilitation – a project it estimates will take five years.

Chris Richards, general manager – closure readiness at the Argyle Mine, tells Jeweller that the company worked with traditional owners, local communities and businesses as well as the West Australian government to develop the closure strategy, focusing on environmental impacts and economic transition.

“While Argyle ceased production at the end of 2020, there is still a long journey ahead to rehabilitate the site,” Richards says.

“This work will provide significant economic opportunities, with our strong commitment to local content helping to ensure that the region benefits, particularly the traditional owner businesses and individuals.

“In this way, the final chapters of the Argyle story are yet to be written and we will continue to be an important part of the East Kimberley community for many years to come,” he adds.

With the closure of Argyle, Australia no longer has a single productive diamond mine.

From making Australia the largest diamond producer in the world in the 1980s, to becoming synonymous with the world’s rarest stones, there is no doubt Argyle has left an indelible mark on the local – and global – diamond landscape. Its absence will be keenly felt, as much as its incredible legacy is assured.