Investing in Pink Diamonds

In these uncertain times, investors are looking for safe havens for their money and diamonds might be a good place to start, especially pink diamonds, because the world’s most reliable source of these pretty-coloured gemstones, the famous Argyle diamond mine in Australia, closes at the end of this year. For the past 37 years, the vast Rio Tinto-owned mine has been producing 90 per cent of the world’s supply of this, one of the rarest most valuable gems on earth.

Via I-M Magazine by Francesca Fearon

In December the very best of the diamonds, a mere 60 or so gemstones each year of scintillating brilliance from sublime purplish-tinged pinks to blue, an occasional violet and red – the rarest of all – will be auctioned in the prestigious annual tender to partner diamantaires like Kunming Diamonds in Hong Kong and Andre Messika in Israel.

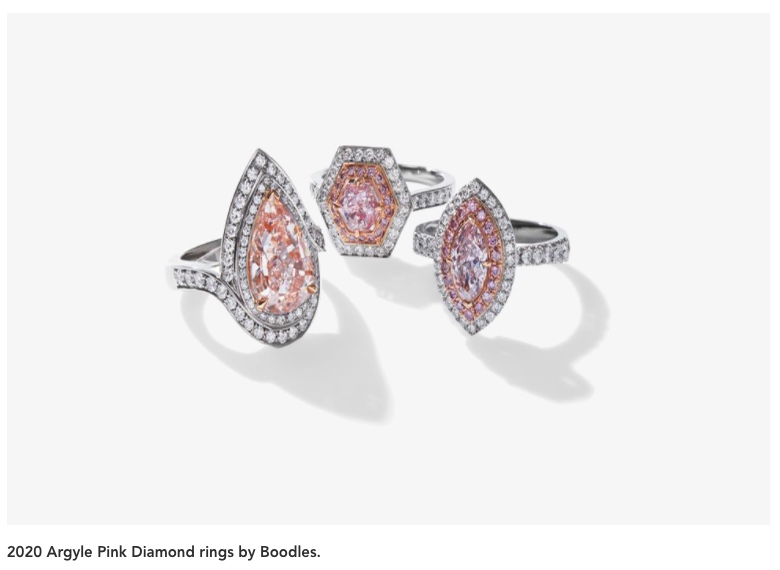

These then will filter through to a carefully controlled global network of ‘select ateliers’ including Tiffany & Co in New York, Chow Tai Fook in Hong Kong, Calleija in Australia and Boodles in London who work the fancy pink diamonds into their creations as highlights, accents or contrast stones that then bear the celebrated Argyle Pink Diamond brand name. This year’s auction is the penultimate offer, there will be one more in late 2021, and so for those who adore pink diamonds, this is a pivotal moment.

These dazzling pink stones range from 1-2.5 carats and as Patrick Coppens, general manager of sales and marketing for Rio Tinto’s diamond business, points out “People who buy one of Argyle’s top-quality pink diamonds join one of the world’s most exclusive clubs, for only around 50-60 carats are offered for sale each year.”

More than 865 million carats of rough diamonds have emerged from Argyle since production began, but only around 0.01 % are pink rough diamonds, that subsequently get cut and polished with varying yields. In fact, the number of high-quality cut and polished pink diamonds to go for tender since 1984 would barely fill two champagne flutes.

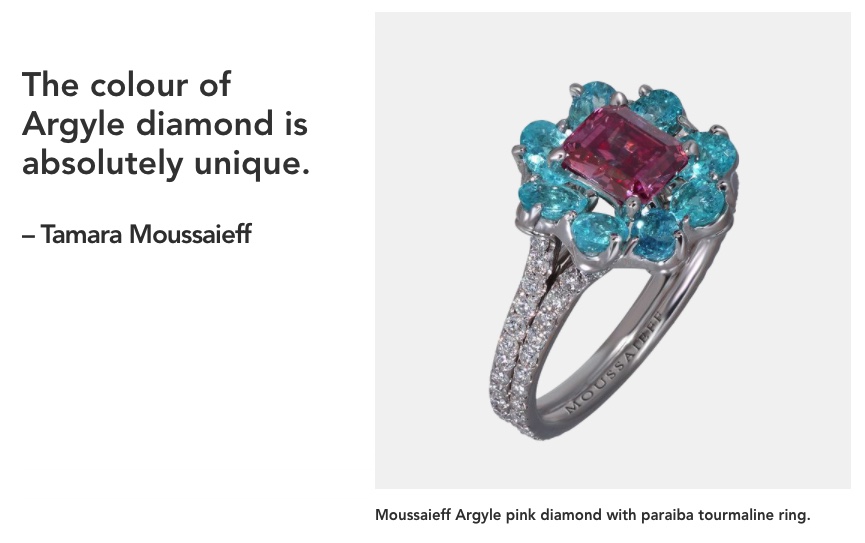

What makes them so special explains Tamara Moussaieff, the gemstone buyer for Bond Street diamond specialists Moussaieff, “is the colour of Argyle diamond is absolutely unique in that it is more deeply saturated than diamonds from other locations.” Their hue and saturation has never been seen before in a diamond and is thought to be the result of very high temperatures and pressures over a long time where they are formed deep in the earth’s mantle.

“Because they are both pink and have a unique saturation, they are more desirable than any other pink diamonds,” adds Moussaieff whose family business was one of the first to buy these diamonds when the mine opened.

Not surprisingly these rare pink stones have investor and heirloom appeal as diamantaire André Messika points out Argyle Pink Diamonds command the highest prices: “The percentage difference could be between 15-30% (to other pink diamonds) due to them coming from the Argyle mine.”

Prices in the annual sealed-bid auctions for Argyle Pink Diamonds have appreciated 500 per cent since 2000. “Even in such unprecedented times, sale of Argyle Pink Diamonds has not only been insulated, but the value has appreciated and is at an all-time high in demand,” says Harsh Maheshwari the executive director of gem merchants Kunming Diamonds.

“Demand for these rare diamonds, generated by collectors, connoisseurs, the new rich that desire these miniature works of art, will continue to grow.”

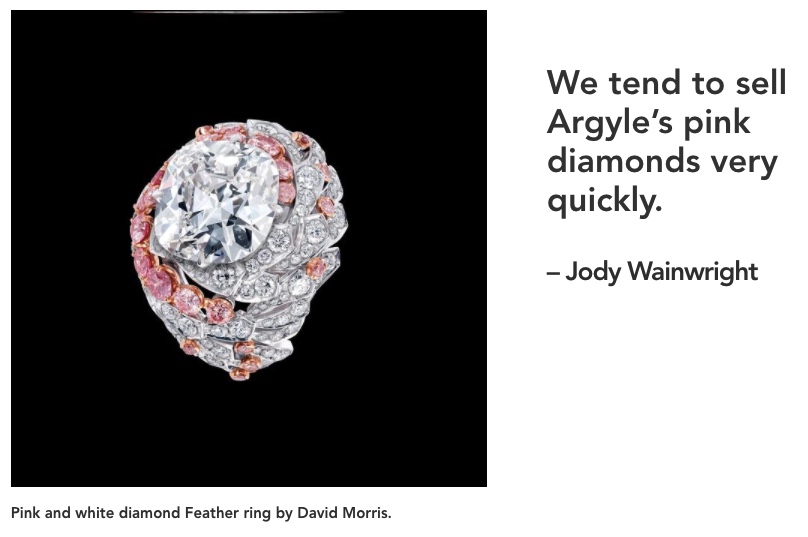

At retail, Boodles director and gemstone buyer Jody Wainwright admits, “we tend to sell Argyle (pink diamonds) very quickly.” The family-owned business was invited into the Argyle circle as one of its authorised retailers in 2014 and was so smitten by the hue that it adopted Argyle’s pink as Boodles’ signature colour.

“We have grown to appreciate both the rarity and the genuine desire held for these precious diamonds,” says Wainwright, who is always looking to acquire more for his clients. He agrees now is the time to invest. Beauty giving birth to desire and rarity, speaking of limited supply are, he says, “the best formulas for increasing prices.”

Their diminutive size, intense hue and consistent supply made the Argyle Pink Diamond incredibly appealing, however, there are other less dependable sources like Russia, Brazil, South Africa and Angola which have sporadically unearthed even bigger gemstones, but these are incredibly rare and wouldn’t satisfy demand. For this reason, pink diamonds can make headline news at auctions. The Oppenheimer family sold at Christie’s Geneva an 18.96-carat pink two years ago for $50,375,000 that was acquired by Harry Winston and renamed the Winston Pink Legacy.

Even more spectacular was the $71.2 million spent in 2017 by the Chow Tai Fook family at Sotheby’s Hong Kong on a 59.60-carat oval fancy vivid pink diamond renamed the CTF Pink Star. The 132.5-carat rough from which this diamond was cut was mined by De Beers in South Africa in 1999 and is the largest pink diamond ever recorded.

Rather more accessibly priced, and wearable is the sweet 3.62-carat fancy pink diamond ring made by the jeweller Meister, circa 1968 that was recently auctioned for £838,750 by Bonhams, London, which has a strong track record with coloured diamonds. Although even that exceeded pre-sale estimates.

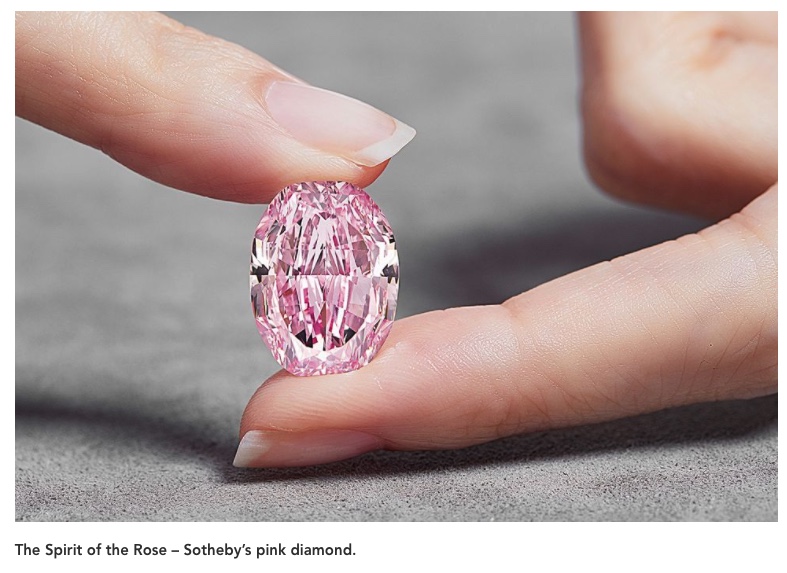

There was also a beautiful flawless pear-shaped 14.83-carat Russian vivid purple-pink diamond, named the Spirit of the Rose, that was auctioned at Sotheby’s Geneva in November for US$26.6 million, a world record for a purple-pink diamond. A diamond-like this really is scarce: one per cent of pink diamonds are larger than 10 carats and only 4 per cent are graded as ‘fancy vivid’ in colour. The gemstone was found in northeast Russia in the Alrosa mine in 2017, which is one of the world’s biggest diamond mines.

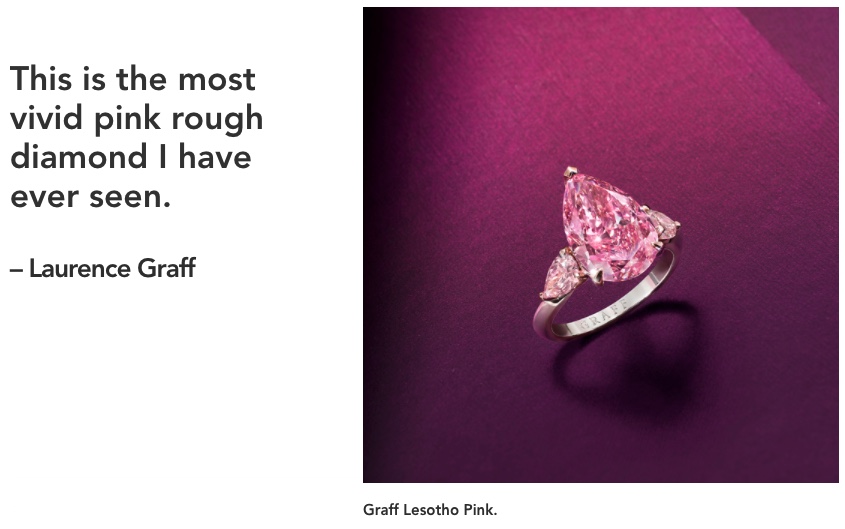

This pink diamond and the 13.33-carat fancy vivid purplish-pink rough bought by Graff from the Letseng mine in Lesotho last year are exceptional stones. Founder and chairman of the jeweller, Laurence Graff was excited to reveal the rough, “This is the most vivid pink rough diamond I have ever seen and is an exceptionally rare treasure,” he says.

He paid $8.75 million for what is now named the Lesotho Pink which so far has yielded a gorgeous 5.63-carat pear-shaped ring. It is not surprising that the desirability of pink diamonds has swelled so much due to their beauty and rarity.

Therefore, it is entirely possible that the exhaustion of this last reliable source means Argyle’s pink diamonds may in the future achieve legendary status akin to that of the Golconda diamonds from India’s earliest gem mines.